It was an odd day, buy the dip won out as usual. SPX getting really close to the 20d, so keep a close eye on that. Tomorrow is the last day of the quarter, expect some window dressing there after these last couple days of profit taking. Though there are not a lot of great looking setups out there, many are getting close to setting back up.

Trading Plan for Friday, 3/30

- SWKS - Looking ok, needs to hold this trend line or it may take a while to set back up to take out this resistance. pulling back on lighter volume, which is good.

- MCP - This one looks really good after breaking out a few days ago. Approaching this next buy/add area.

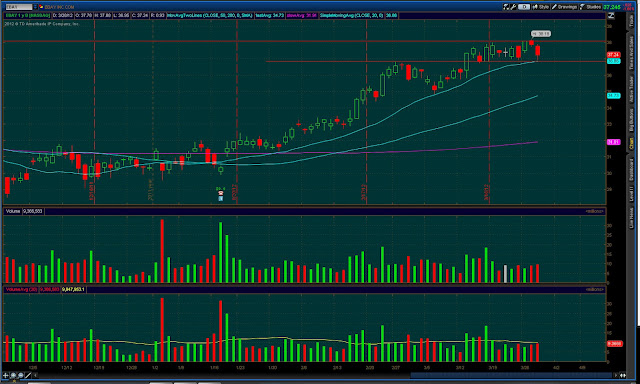

- VMW - Busting through this next buy/add area on heavy volume. Watch for a good FTD (follow through day)

- ALLT - Showing some resiliency after yesterdays big red candle, keep on watch to break through that 23 area.

- INFA - Nice big bullish engulfing candle, looking good to go higher

- AMZN - Continuing to hold above the 200d, keep a eye on this one.

- CRM - Continues to work well, next buy/add area when breaks out to new highs on volume

- ZAGG - Pulling back to test the 20d, if it holds it looks good to test the 200d

- TNGO - Massive volume today, but price action isn't following, be careful... but one could go long on a break over 20.05

- BRCM - This one is setting up to take this resistance over 39 out.

- BIIB - Consolidating after a nice big run, keep an eye on this one

- NOV - Holding up after trying to put in a double bottom here. one can buy here with the bottom area as a stop or wait until it clears this descending trend line.

- DE - Keep an eye on this one and how it acts at this support and 200d

- ADBE - Window dressing tomorrow could push this one through this next buy/add area

- QCOM - Holding above this support area, I think a straddle may pay off well here on a pullback

- FCX - This one will have to commit over the next week or two, watch this triangle.

- AZO - Watch this one as it approaches this support...

- TS - If it breaks this support, more downside to come imo

- UA - Broke the 20d and this next support. more downside to come imo, may stop around 89.30 or may test the 50d

- OPEN - This one looks like it wants lower to me...

- PEET - Ouch, massive pullback on heavy volume... Always stick to your stops, peel some off into strength, and raise your stops.

- MOS - Breaking this ascending trend line on heavy volume, if it breaks this next support area, more downside imo...

Charts

ADBE

ALLT

AZO

BRCM

DE

FCX

INFA

MOS

NOV

QCOM

TNGO

TS

UA

VMW

ZAGG