It was a heck of a week! We had some big winners on both the pullback and following rally. I missed many of the good moves and my portfolio was up about 28% this week. The best movers this week were the stocks that ignored the pullback, always remember that. Any time a stock ignores a pullback in the overall market, it should move to the top of your bullish watch list.

Trading Plan for the Week, 3/12-3/16

- MCP - 34 - This one broke out on heavy volume Friday, You can't go wrong on these big volume breakouts unless the overall market tanks imo. Stick to your stops

- FIRE - 48.38 - Watch for this one to go higher, it had good volume and a nice big candlestick on friday

- SINA - 77.50 - This one poked through this resistance on good volume, one could buy here with this line as a stop.

- SHLD - 83.34 - This one had a nice follow through day after breaking this descending trend line, next buy area when it clears this resistance on volume, needs a consolidation/pullback imo

- WDC - 41.40 - Big rally on volume Friday, next buy area when clears this resistance area on volume.

- ALLT - 18.30 - This one tested the upper line on this handle (cup w/handle formation) when it clears on volume go long

- NTAP - 43.50 - Watch for the break of is descending trend line, go long when it breaks

- UA - Had a nice FTD (follow through day) watch for this one to break the century mark

- BEAM - 56.50 - Nice FTD after a breakout Thursday on big volume. Next buy area when clears 56.50 on heavy volume

- ADBE - Keep on watch.

- PEET - Had a good FTD Friday after a big breakout and price move

- BRCM - 36.70 - Poked its head through this descending trend line on this cup w/handle formation. Next buy area when clears the 20d on volume.

- HFC - Working nicely since breaking out on Thursday

- NFLX - Could go either way, watch for a break of this descending trend line or break below the 50d

- BIDU - Doji's all the way up to get to this descending trend line, after a failed breakout... I don't trust it... stick to your stops if you go long.

- QCOM - One could buy here with 63.50 as a stop.

- SODA - Continues to look like crap, avoid unless short

- CRM - 148 - Cleared this consolidation channel on Friday, next buy area is when it clears 148 on volume. broke out on lighter volume, so be cautious

- PETM - Had a nice FTD after breaking out on heavy volume Thursday.

- WFC -32 - Broke back out of this consolidation channel on fair volume, next buy area when clears 32 on volume

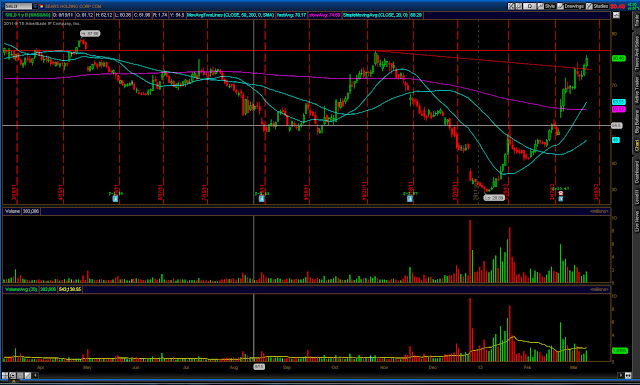

- GLD - Keep on watch, if it breaks 200d, should make a good short.

- INFA - 50.75 - Another nice looking cup w/handle when it breaks this resistance on volume, go long.

- AAPL - 550 - Pulled back and held up, once it breaks 550 on volume it could see 600 quickly.

- BIIB - 122.50 - Held up over this breakout, poised for new highs. One could buy here with a 120 stop.

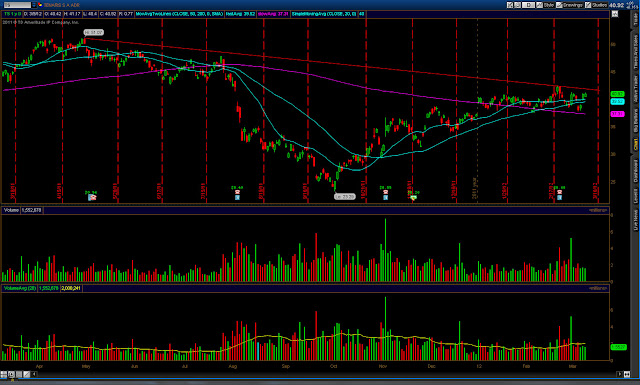

- TS - 42 - Keep an eye on this one, looks poised to break this descending trend line

- BBBY - 63 - This one broke out Thursday on solid volume, but may have double topped. long over 63 on volume or short under 62.25 on volume.

- NOV - 82.30 - Another one that looks like it will break down, watch these trend lines and act accordingly

- NVDA - I still think this is a nice short setup, watch for it to break this ascending trend line on volume and go short imo.

- LNKD - This one broke the upper channel of this cup w/handle pattern. next buy area when clears 94.50-95 on volume. or one can buy here with a $1-$2 stop

- VZ - Continues to act well after breaking out on 3/1

- CVX - Banging its head on this resistance, the key here is a breakout on MASSIVE volume

- LVS - Having some major volatility, watch for it to stabilize and set back up

- GOOG - Consolidating in this channel, play the line it breaks on volume

- CRR - Worked well for us this week, let it consolidate and buy the break of 100

- AMZN - 187.70 - Broke this descending trend line, back-tested friday, now watch for it to hold and break up or just break down, play accordingly

Charts -

AAPL

ALLT

AMZN

BBBY

BEAM

BIDU

BIIB

BRCM

CRM

GOOG

HFC

INFA

LNKD

MCP

NFLX

NOV

NTAP

NVDA

SHLD

SINA

TS

UA

WDC

No comments:

Post a Comment