Nice consolidation day today, learn to appreciate these since they allow the charts to set back up. Had a nice little rally the last hour, signaling that buy the dip is still in effect. On to tomorrow!

Trading Plan for Wednesday, 3/29

- AMZN - Struggling at this resistance and could use a rest after this big run. Holding above the 200d, keep on watch.

- FCX - This one is in between pivotal areas, the downward pressure from the MA's should push it to test this support line first. Next buy area when clears this descending trend line on heavy volume.

- BIDU - This one is getting some good consolidation as it hits this resistance area. One can buy or add when it clears 152.50 on volume. Always take profits into strength. If it drops below this next support it may retest this rising trend line.

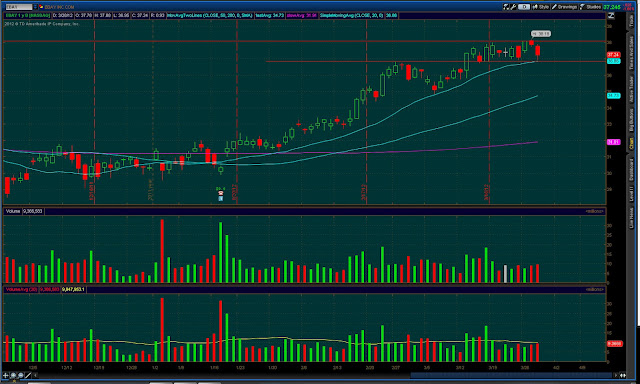

- EBAY - Looking good for more highs, building a nice solid base to springboard off of. Next buy add area when clears 38.25 on heavy volume

- NVDA - I hesitate to mention this piece of junk, but it cleared back over the 50d on heavy volume today, while the rest of the market was sucking. So it deserves a mention, watch for a nice FTD (follow through day) and maybe take a small position long.

- BAC - Fought the selling today, continuing to build a nice base. Buy/add when clears 10.10 on heavy volume

- WFC - Also fought the selling, next buy add when clears 34.70 on heavy volume.

- GOOG - Continuing to work well, next buy add when making new highs on heavy volume

- PEET - Working well our initial two buy/add points. Next buy/add when clears upper line on heavy volume (new highs)

- NOV - Easy buy here on the double bottom. Perfect formation. One can go long with this support line as a stop.

- CRM - Holding up well after the false break above this resistance area, keep on watch

- GS - Consolidating below this next resistance area, when it clears one can buy/add

- BIIB - This one is holding up just fine after breaking out to new highs, one can buy/add on pullbacks with a $2-$3 stop

- ADBE - Keep on watch, looks like this one wants to break through this resistance to new highs...

- SPY - May be reaching terminal velocity here...

- OPEN - Reaching decision time, one can play either break on volume accordingly.

- AZO - Looking like this one wants to fill the gap imo... Watch how it acts at this support and if/when the gap fills. Great stock.

- VZ - Toast, avoid unless short. 37.35 is the next support area.

- JAZZ - No Buenos imo... Head and shoulders pattern forming here, needs to breakout soon or it may have a huge down turn.

- GLD - Not sure why this unconventional trend line has worked so well, but it has.

- UA - Testing the 20d (holding up) if it closes below, watch this next support

- MCP - Holding up after this next buy/add area, keep a close stop...

- ALLT - Don't like todays big red candle on big red volume... keep a close stop

- GMCR - Another one that is toast, avoid unless short, looks like it'll test 40 if it can't hold 48

- SODA - More downside to come here, breaking through this next support on heavy volume...

- SHLD - If it loses this support, there is a lot of downside, really fast imo...

Charts -

ADBE

AMZN

AZO

BIDU

CRM

EBAY

FCX

GLD

GMCR

JAZZ

MCP

NOV

OPEN

PEET

SHLD

SODA

SPY

UA

No comments:

Post a Comment